Common fund trading during the time’s avoid net investment really worth, will be earnestly addressed, has high charges, it is possible to minimums, and you will automatic bonus reinvestment alternatives. ETFs are typically passively https://www.globaloptics.es/finest-this-market-systems-in-the-us-2025/ addressed, which means financing usually keeps a predetermined quantity of securities considering a specific predetermined index out of investment. Alternatively, of many mutual finance is actually definitely managed, that have professional buyers seeking discover the assets which can go up and you may fall. Really ETFs are passively addressed investments; they simply song a list.

Finest ETF Systems and you may Brokers of 2025

At the same time, information regarding ETFs holdings, efficiency and can cost you is published daily and you can freely available for the equipment web page per ETF. It doesn’t capture a lot to start, and they days a knowledgeable brokers allows you to purchase fractional offers no exchange payment. It indicates you could wade grab a share out of an ETF otherwise element of a share with a few of your own free alter. People quotes according to earlier overall performance do not a hope future overall performance, and you may prior to one money you should mention your unique financing demands otherwise talk to a professional elite. The market price of an ETF will depend on the values of your holds and you may ties held by the ETF, along with business likewise have and you can demand. The process of selling offers of one ETF and purchasing offers of another provides dos procedures—just like the procedure for selecting and you may attempting to sell stocks.

Whether you’re a beginner otherwise a talented trader, certain tips helps you navigate the new ETF industry and then make told financing behavior. Respond to once-times business situations and you can immediately cracking reports which have twenty four-hour exchange to the the now’s extremely generally traded ETFs. Support service representatives can also help answer questions you might provides and so are on the telephone Saturday thanks to Saturday while in the expanded regular business hours. Firstrade’s smooth mobile change app will enables you to song your profile on the go and set any required investments whenever you’re from your dining table. Here are the best on the web agents to have ETF investing and just why you have to know her or him. Preferred fund recording the fresh S&P 500 range from the Cutting edge 500 Directory Fund ETF (VOO -0.11%) as well as the SPDR S&P 500 ETF Faith (SPY -0.12%).

How Try an ETF Distinctive from a catalog Financing?

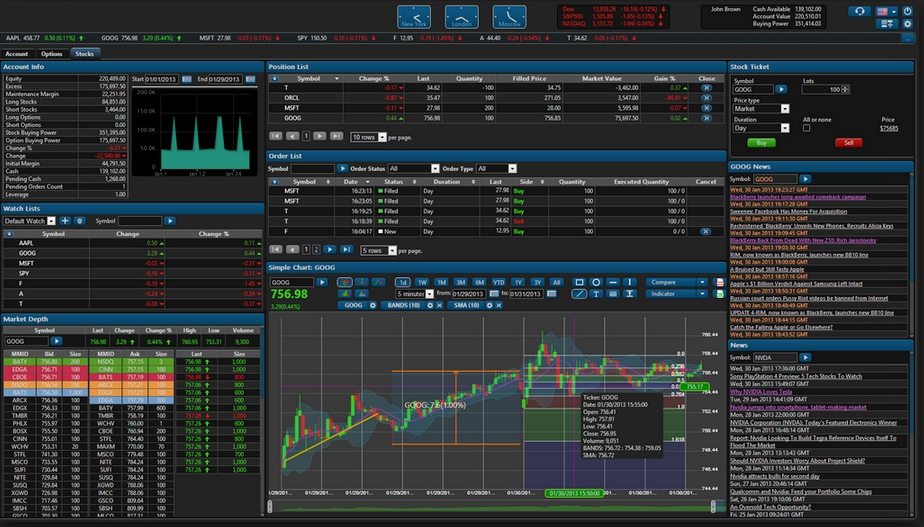

Viewing ETFs is essential in making advised exchange conclusion and you will promoting investment production. Investors constantly mix fundamental study, business belief, and you can tech investigation for top complete comprehension of exactly how the new resource will manage. People engaging in genuine-currency change gain worthwhile knowledge to the business decisions, risk administration procedures, as well as the mental aspects of trade.

Tips Invest in ETFs for beginners

The ETF screener covers more 150 global places that is very personalized. Motilal Oswal makes it possible to acquire after that insight into ETF change tips. You could use the 100 percent free Demat take into account your ETF change needs. Track record — Evaluate an ETF’s history to check on if this has met its overall performance goal. In general, you ought to comment one seasons of genuine efficiency background, because so many ETFs would be to create similarly to the root standard list. Its also wise to opinion how benchmark list itself changed over time, because this may cause the newest ETF to perform in different ways.

Credit exposure refers to the chance the personal debt issuer often struggle to build dominant and desire costs. Our very own ETFs and you can directory capabilities offer hundreds of possibilities so traders is assemble their particular collection playbooks. This article shouldn’t be depended on since the lookup, investment suggestions, otherwise a suggestion of one things, actions, or people defense particularly.

More common inventory ETFs track benchmark spiders like the S&P 500 or Dow 29. For example, the brand new SPDR S&P five hundred (SPY) is continually more energetic asset that have the typical daily frequency surpassing 80 million shares in the 30 days before January a dozen, 2024. What number of inventory ETFs which can be change from the United Claims, at the time of 2024, giving traders a large number of prospective money to choose from. The assistance wanted to subscribers will vary reliant the service chose, and government, costs, eligibility, and you will use of a coach. Discover VAI’s Function CRS and each program’s consultative brochure here to own a synopsis. This type of funding points hold several to a huge number of stocks, securities, and more.

- The newest ETF and you can shared financing screener aids near to a hundred details so you can narrow down the fresh lookup and you will lets people to find ETFs by the wished protection.

- These types of techniques try to surpass simple industry-cap-adjusted indicator otherwise mitigate profile chance from the using various other weighting dependent to the particular items (small-limit, value. quality, etc.).

- The marketplace price can change in the trading go out and could getting over or underneath the overall worth of the new stocks and you can ties the fresh ETF invests in the.

- The fresh SPY, which had been stated before, charge an annual doing work debts of 0.0945% of the fund’s net possessions.

- Consequently traders can obtain market ETF offers as a result of brokerage membership inside exchange times of one’s change where the ETF is actually indexed.

- You’re entitled to crack issues — otherwise all the way down costs — if you invest a quantity with a certain mutual finance loved ones.

Industry price of a keen ETF are driven to some extent because of the likewise have and consult. Based on such market forces, the market rates is generally above otherwise beneath the NAV from the brand new money, which is labeled as a paid otherwise discount. Here are certain reasons why you should consider incorporating it common investment to help you your profile. Rating stock information, profile suggestions, and a lot more regarding the Motley Fool’s advanced services. This type of consist of the newest 100 largest in public places detailed companies regarding the nation.

A keen ETF are a transfer-traded finance one to tracks a directory

Thus, the brand new fund’s efficiency get deviate slightly out of compared to the newest directory for the which it is based. Part of the difference in change-exchanged financing (ETFs) and you may common finance would be the fact ETFs, including stocks, can be bought and marketed in the change time. Concurrently, shared money are only able to be bought at the end of for every trading trip to an amount in accordance with the finance’s online resource really worth. ETFs is actually traded on the transfers identical to private carries, which means that they’re exchanged from the change go out. Go out trading comes to selling and buying financial devices in the exact same change go out, wanting to make the most of brief-term price moves. Costs rates influence the newest profitability away from an enthusiastic ETF, while they portray annual charge subtracted in the financing’s possessions and certainly will gradually deteriorate your production throughout the years.

With its tiered commission structure and you can entry to ETFs across individuals exchanges, they provides productive traders and people with state-of-the-art investment tips. For individuals who’lso are seeking to fill a specific package – highest American development organizations, for example – the fresh screener makes it possible to do this quickly. They have a tendency to suggests iShares and Innovative fund, though you’lso are absolve to pick any ETFs on Merrill’s platform. A keen ETF, while the a good leveraged CFD, is actually a financial tool that allows investors to take a position on the rates moves from ETFs as opposed to getting the underlying assets.

The new SPY, which had been said earlier, charge a yearly working costs of 0.0945% of the fund’s net assets. One fee is subtracted from the fund’s earnings, maybe not from the brokerage account. Although on the web brokers give fee-free change, you’ll want to show simply how much it can cost you, when the anything, for each and every pick or offer transaction. After that considerations were if or not you’ll find account minimums and you can fees to possess transferring your bank account to some other standard bank later on. Among the best and you can greatest a method to generate a great varied profile is by using using change-replaced financing (ETFs), which give you access to numerous holds in one single fund in the very low fees.